露华浓申请破产保护、道指跌破3万点…睿问美国财讯集汇

《露华浓申请破产保护、道指跌破3万点…睿问美国财讯集汇》

睿问商务ReveMgt【睿问财讯-国际】

(含英文原稿,供读者学习参考,中文翻译编撰可能同原稿有一定差异)

《露华浓于周三晚间申请破产保护》

露华浓于周三晚间申请了《破产保护法》第11章的破产保护,该公司正面临着沉重的债务负担和混乱的供应链。

该公司表示,预计将从现有贷款人那里获得5.75亿美元的债务人占有融资,这将有助于支持其日常运营。

露华浓是第一家申请破产保护的面向消费者的大型企业,这是零售业一年多来的停滞而带来的困境。

Revlon filed for Chapter 11 bankruptcy protection on Wednesday evening as it grappled with a cumbersome debt load and a snarled supply chain.

The company said it expects to receive $575 million in debtor-in-possession financing from its existing lender base, which will help to support its day-to-day operations.

Revlon is the first major consumer-facing business to file for bankruptcy protection in what has been a yearslong pause of distress in the retail sector.

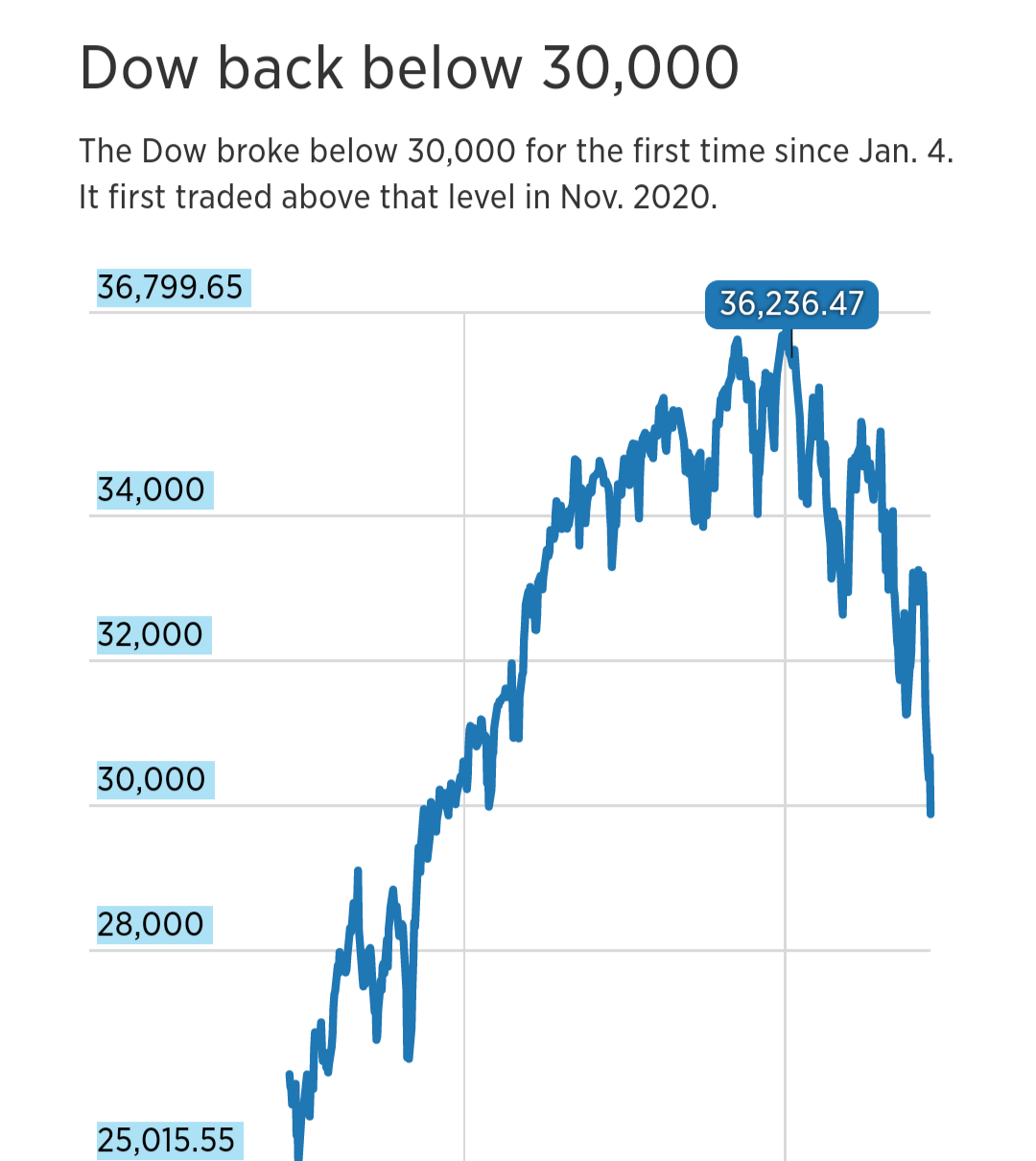

《道指下跌800点,跌破30000点,创一年多来最低水平》

纽约—道琼斯工业平均指数周四(美国时间6月16日)跌至关键的30000点以下,投资者担心美联储对通胀采取更激进的措施会使经济陷入衰退。

美联储宣布自1994年以来最大幅度的加息后,道琼斯指数周三反弹,但现在扭转了这些涨幅,在今日跌至2021 年1月以来的最低水平。

标准普尔500指数和纳斯达克综合指数均处于熊市区域,分别较1月和11月的历史高点下跌约23%和34%。与此同时,道琼斯指数比1月5日创下的盘中高点低约19%。

Dow falls 800 points, tumbling below 30,000 to the lowest level in more than a year

The Dow Jones Industrial Average tumbled below the key 30,000 level on Thursday as investors worried the Federal Reserve’s more aggressive approach toward inflation would bring the economy into a recession.

The Dow had rallied on Wednesday after the Fed announced its largest rate hike since 1994, but reversed those gains and then some on Thursday, tumbling to the lowest level since January 2021.

The S&P 500 and Nasdaq Composite are both in bear market territory, down roughly 23% and 34% from their all-time highs in January and November, respectively. The Dow, meanwhile, is about 19% below its Jan. 5 all-time intraday high.

《美国房产贷款需求同比跌52.7%》

随着利率进一步上升,抵押贷款需求目前约为一年前的一半。

根据抵押贷款银行家协会(mortgage Bankers Association)的季节性调整指数,上周抵押贷款申请总量比一年前同期下降了52.7%。

专家表示:抵押贷款利率跟随国债收益率上涨,以应对高于预期的通胀,并预计美联储将需要加快加息步伐。

Mortgage demand is now roughly half of what it was a year ago, as interest rates move even higher。

Total mortgage application volume was 52.7% lower last week than the same week one year ago, according to the Mortgage Bankers Association’s seasonally adjusted index.

“Mortgage rates followed Treasury yields up in response to higher-than-expected inflation and anticipation that the Federal Reserve will need to raise rates at a faster pace,” said Joel Kan, an MBA economist.

CnBays.com湾区中国|睿问商务ReveMgt【国际财讯】综合海外权威财经信息,原创编译整理。浦诺英英文精英翻译供稿。

【声明】:本文英文版权属原作者所有。有来源标注错误或文章侵犯了您的合法权益,请作者持权属证明与本网联系,我们将及时更正、删除,谢谢。